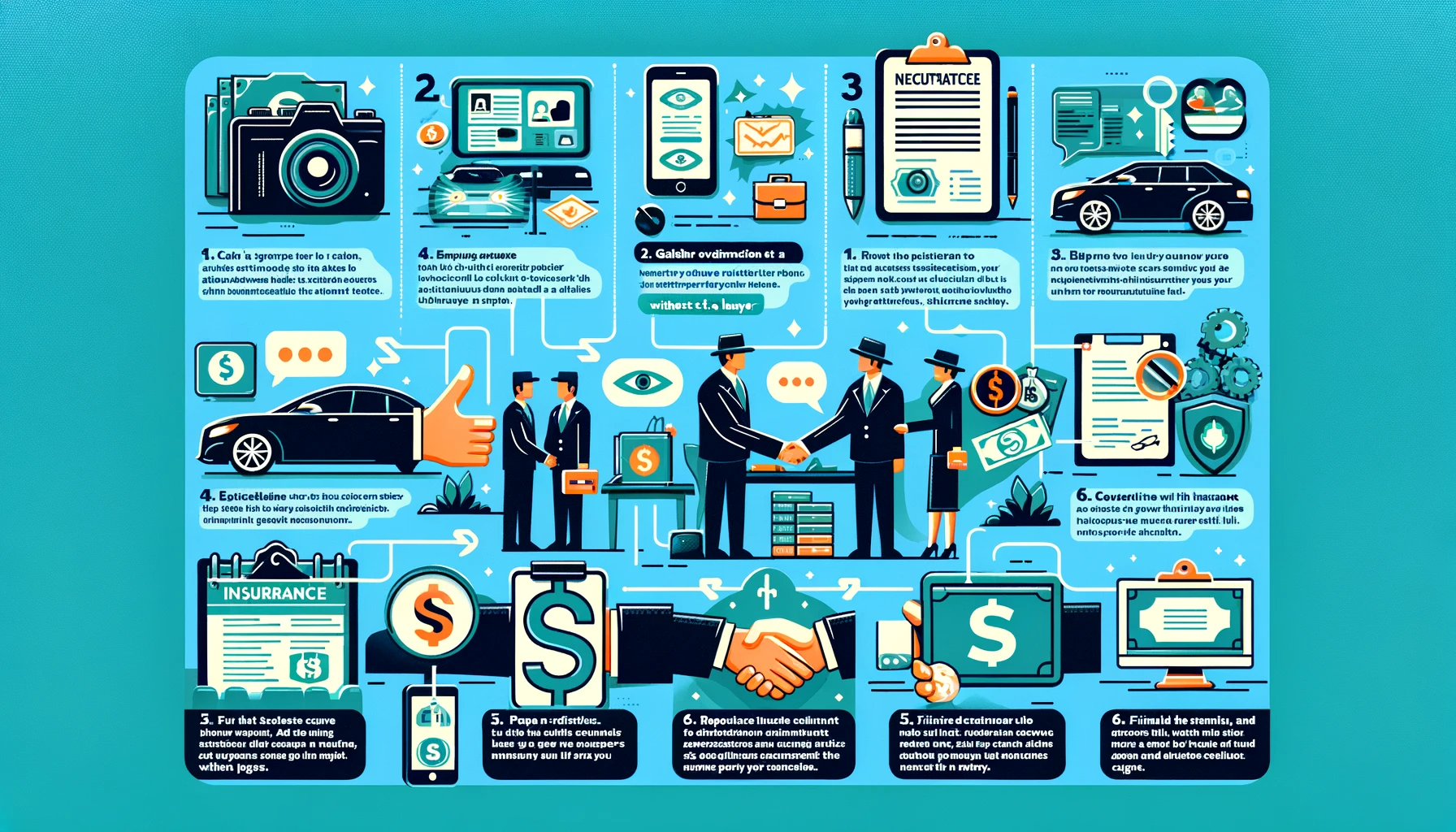

In the aftermath of a car accident, dealing with vehicle damage, potential injuries, and insurance claims can feel overwhelming. While seeking legal counsel is often advisable, certain situations might allow you to navigate a car accident claim settlement on your own.

This guide empowers you with the knowledge and steps necessary to travel the road to resolution, helping you settle your car accident claim without a lawyer. By un

derstanding the process of assessing damages, gathering evidence, negotiating with insurance adjusters, and understanding settlement offers, you can take control of the situation and work towards a fair resolution.

Remember, this guide serves as a starting point, and consulting with a lawyer is always an option, especially if the accident was complex, injuries are severe, or you’re unsure about any aspect of the claim.

Table of Contents

Important Considerations Before You Begin

Accident Severity:

When an accident results in serious injuries, leaves fault unclear, or presents a complicated situation, seeking legal representation becomes crucial. In these circumstances, the potential for significant compensation and the intricate aspects of the case demand the guidance of a lawyer. Evidence collection takes on paramount importance, as strong evidence strengthens your claim.

Furthermore, navigating the complexities of medical bills and the potential for long-term health consequences requires the expertise a lawyer can provide to ensure you receive the full compensation you deserve while managing the often-overwhelming medical aspects of the situation.

State Laws:

The legal procedures and deadlines for pursuing compensation after an incident can vary significantly depending on the state you’re in. To ensure you don’t miss out on potential compensation, it’s vital to research the specific requirements in your jurisdiction.

Statutes of limitations establish a strict timeframe within which you must file a claim. If you miss this deadline, you might be completely barred from seeking any compensation for damages or injuries.

Furthermore, some states have mandatory reporting requirements for accidents that exceed a certain threshold of damage.

Familiarizing yourself with these legalities can help you avoid unnecessary delays and guarantee you’re following all the regulations set forth by your state. By understanding these state-specific laws, you can position yourself for a smoother and more successful claim process.

Your Comfort Level:

Feeling lost in a maze of legalese or paralyzed by the thought of battling insurance companies for what’s rightfully yours? Don’t let legal matters become a source of undue stress. Seeking guidance from a lawyer can be the key to reclaiming your peace of mind.

Lawyers are trained professionals adept at navigating complex legal landscapes. They can take the reins on the often-overwhelming claims process, allowing you to focus on what truly matters – your recovery, whether that means healing from an injury, rebuilding after property damage, or simply getting the financial compensation you deserve.

Gathering Your Evidence:

Building a Strong Case

Building a strong case hinges on meticulous evidence gathering, as thorough documentation bolsters your claims and empowers you during negotiations. This evidence collection process should be akin to constructing a persuasive narrative, where you meticulously accumulate various forms of proof that collectively illuminate the validity of your position.

Remember, the stronger the foundation of evidence you assemble, the more persuasive your arguments become, ultimately increasing your leverage and tipping the scales in your favor during critical discussions.

Accident Scene Details:

When dealing with an accident, thorough documentation is crucial for a smooth insurance claim process. The first step is to capture the date, time, and exact location of the incident. Weather conditions at the time of the accident are also important to note, as rain, snow, or fog can all be contributing factors.

Next, use your phone or camera to take detailed pictures of the damage to all vehicles involved. Include close-up shots of any dents, scratches, or deployed airbags to clearly show the extent of the damage. Don’t forget to capture the broader accident scene as well.

This means photographing any skid marks on the road surface, as they can indicate where a vehicle suddenly braked or lost control. Additionally, include pictures of any relevant traffic signs or signals that may have played a role in the accident.

By gathering this comprehensive visual record, you’ll be providing your insurance adjuster with a clear and accurate picture of the entire event, helping to ensure a fair and efficient resolution to your claim.

Police Report:

Securing a copy of the official police report generated after an accident is crucial, as it serves as a comprehensive record of the incident. This report compiles witness statements, which provide firsthand accounts of what transpired, along with observations made by the responding officers.

These observations can include details about the accident scene, vehicle positioning, and any potential contributing factors. The documented information within the police report plays a vital role in establishing the sequence of events that led to the accident, and it can be instrumental in determining which party, if any, may be held liable for the damages and injuries sustained.

In short, the police report serves as a critical piece of evidence that can significantly influence the course of an insurance claim or even a potential legal case.

Medical Records:

In the aftermath of an accident, it’s vital to comprehensively document any injuries you sustain, regardless of whether they appear minor initially. Promptly seeking medical attention and diligently collecting all receipts and bills associated with that treatment is paramount.

This meticulous record-keeping serves a two-fold purpose. Firstly, it establishes a clear picture of the nature and severity of your injuries through detailed medical records. Secondly, this documentation becomes a crucial piece of evidence when calculating fair compensation to cover the often substantial costs of medical care linked to the accident.

By thoroughly documenting your injuries and related medical expenses, you strengthen your position in securing the appropriate compensation to help you recover from the accident.

Proof of Lost Wages:

In the unfortunate event that an accident forces you to miss work, it’s crucial to gather solid proof of the income you’ve lost. This documentation serves as your key to recouping those lost wages.

Examples of such proof include pay stubs that detail your typical earnings before the accident, or a formal letter from your employer that verifies both your absence due to the accident and your usual rate of pay.

Having this documentation readily available strengthens your claim and helps ensure you’re fairly compensated for the financial losses incurred as a direct result of the accident.

Communicating with Insurance Companies

Contact Your Insurance Company First:

In the immediate aftermath of a car accident, prioritizing your safety and understanding your legal rights is crucial. The first step you should take is to contact your insurance company and report the accident as soon as possible.

Provide them with a clear and accurate account of what happened, cooperating fully with their investigation. It’s important to be truthful and factual in your report, but avoid admitting fault for the accident.

Instead, focus on giving a neutral and objective description of the events leading up to and including the collision. Be sure to be honest about any injuries you sustained and avoid downplaying the severity of the damage to your vehicle.

By following these steps, you can protect your interests and ensure a smoother claims process with your insurance company.

Exchanging Information with the Other Driver’s Insurance:

In the aftermath of a car accident, exchanging information with the other driver’s insurance is crucial for a smooth claims process. This involves acquiring the contact details for their insurance company, which will be used to file and settle any damages.

Remember, courtesy is key during this exchange. Provide all necessary information like your name, contact details, and insurance details in a factual and professional manner.

However, it’s important to strike a balance between cooperation and unnecessary disclosures. While you should share essential details to move the claim forward, avoid rambling or offering explanations that could be misinterpreted as an admission of fault.

Stick to the facts and refrain from speculating about the cause of the accident. If you’re unsure about what to disclose, it’s always best to err on the side of caution and simply provide the basic requested information.

Negotiating a Settlement: Understanding Your Worth

Itemize Your Damages:

In order to ensure a successful claim, it’s crucial to meticulously document all the expenses and inconveniences stemming from the accident. This includes a breakdown of car repairs and medical bills, along with lost wages due to missed work.

While pain and suffering can be intangible, creating a record of how the accident has impacted your daily life significantly strengthens your case. This can be achieved by keeping a detailed journal that tracks the limitations caused by your injuries.

Documenting things like missed social engagements or the inability to perform regular tasks provides a clear picture of the accident’s real-world consequences, bolstering the legitimacy of your pain and suffering claim.

Research Fair Compensation:

Determining fair compensation after an accident requires a thorough investigation into what constitutes a just settlement in your specific situation. To achieve this, you should delve into the average settlements awarded for accidents with similar characteristics within your local area.

Here’s where factors like the severity of your injuries, the amount of wages you lost due to the accident, and the cost of repairs to your vehicle become crucial.

By gathering information from reliable sources such as industry reports, legal websites, and past court cases involving accidents that closely resemble yours, you can establish valuable benchmarks to guide your understanding of fair compensation.

This multi-pronged approach equips you with a strong foundation for navigating the complexities of accident settlements.

Negotiate with the Insurance Adjuster:

When the insurance adjuster arrives to evaluate your claim, expect them to propose a settlement amount. This is where your preparation comes in – be ready to negotiate! Politely, but firmly, justify your requested compensation with the evidence you’ve meticulously gathered.

Receipts, repair quotes, and even documented medical expenses (if applicable) will all play a crucial role in strengthening your case. Don’t be surprised if the initial offer feels low – it’s often a starting point for negotiation.

Here’s where your research shines – counter their offer with documented proof of your losses, alongside evidence (like online resources or industry data) that reflects fair compensation for similar situations.

By combining your collected materials with polite persistence, you’ll be in a much better position to reach a settlement that truly reflects the cost of getting you back on your feet.

Don’t Settle for Less:

Don’t let the initial offer from an insurance company be the final word. It’s common practice for them to begin negotiations low in an attempt to settle claims swiftly. Remember, you deserve fair compensation, and that means meticulously documenting your expenses and losses.

With this research in hand, you can counter their offer with a well-justified claim that reflects the true cost of the incident. By taking a firm stance and presenting your evidence, you can move the conversation towards a settlement that accurately reflects the situation.

check it

Frequently asked Questions

Here are 10 frequently asked questions to guide you through settling a car accident claim without a lawyer:

Should I ever attempt to settle without a lawyer?

It’s advisable to consult a lawyer for severe injuries, disputed fault, or complex accidents. For minor accidents with minimal damages and straightforward fault lines, self-directed settlement can be an option.

What’s the timeframe for filing a claim?

Every state has a statute of limitations dictating the deadline for filing an insurance claim. Missing this deadline could prevent you from seeking compensation altogether. Research your state’s specific timeframe.

What evidence should I absolutely collect?

Photos of vehicle damage, the broader accident scene (including skid marks and relevant signage), and the date/time of the accident.

Report the accident promptly and accurately. Cooperate with their investigation but avoid admitting fault. Be factual and don’t downplay the severity of the accident or your injuries.

How do I deal with the other driver’s insurance company?

Be polite and factual when exchanging information. Provide necessary details but avoid volunteering unnecessary information that could be misconstrued as an admission of fault.

What if the insurance company offers a lowball settlement?

Do not feel pressured to accept the first offer, especially if it doesn’t cover your documented expenses and losses. Research fair compensation for similar accidents in your area and use that research to counter lowball offers with a well-justified counterproposal.

How do I determine the value of my pain and suffering?

Pain and suffering can be subjective, but documenting the accident’s impact on your daily life strengthens your claim. Keep a detailed journal that documents limitations caused by injuries and how they affect your daily routine.

Are there resources to help me value my claim?

Industry reports, legal websites, and past court cases involving similar accidents can provide valuable benchmarks for fair compensation. Utilize these resources to research settlements for similar situations.

What should I do if negotiations reach an impasse?

If you can’t reach an agreement with the insurance company, consider consulting a lawyer to assess your options. A lawyer can advise you on the possibility of filing a lawsuit or mediate negotiations to reach a settlement.

What happens after I reach a settlement agreement?

Once you reach an agreement, review the settlement document thoroughly before signing. The document should clearly outline the agreed-upon compensation amount and specify what expenses it covers. Once signed, you cannot reopen negotiations for more compensation.